GST Admission 2024: Welcome to our comprehensive guide on GST Admission! In this article, we will delve into the GST Admission 2024 process’s intricacies, offering detailed insights and valuable information to help you navigate the requirements, procedures, and benefits associated with this highly sought-after qualification.

Understanding GST Admission 2024

GST Admission 2024 refers to the process through which individuals can be admitted into prestigious educational institutions offering programs related to General Science and technology. These programs equip students with the necessary knowledge and skills to excel in the fields of taxation, accounting, and financial management.

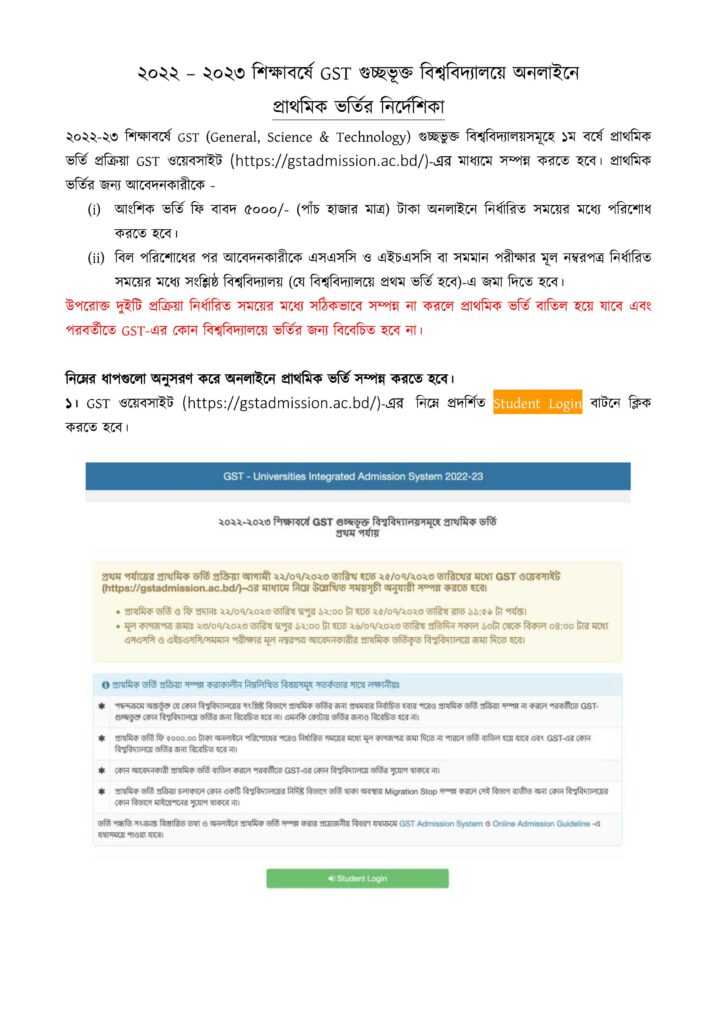

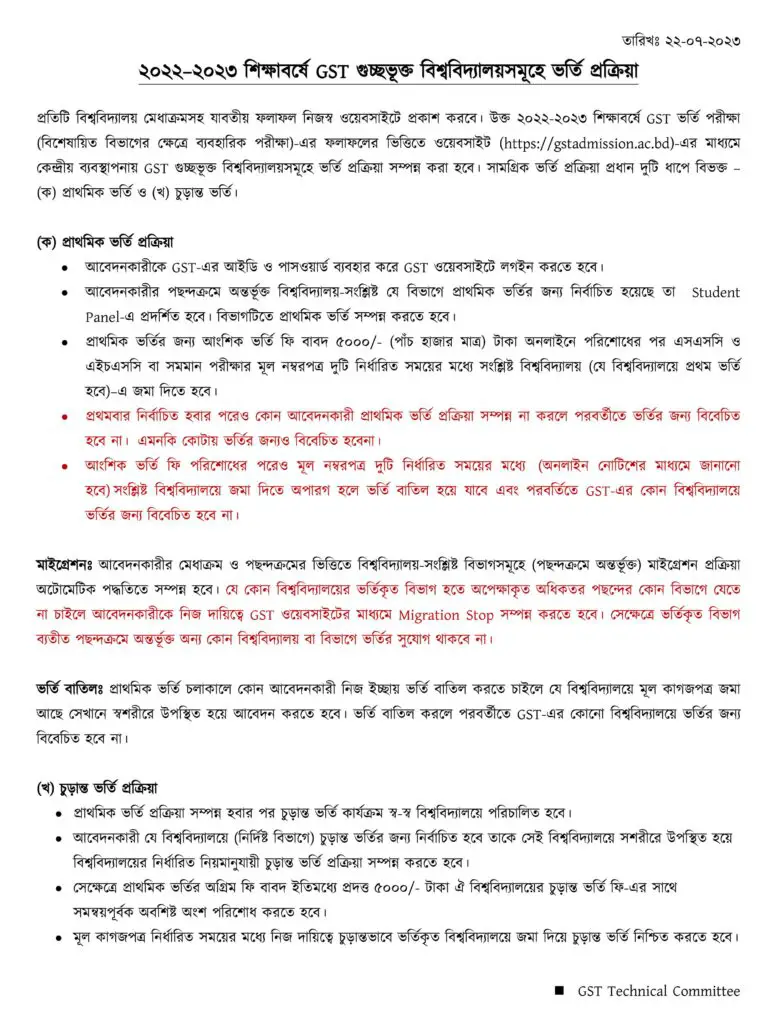

Official website: https://gstadmission.ac.bd/

২০২২-২০২৩ শিক্ষাবর্ষে GST গুচ্ছভূক্ত বিশ্ববিদ্যালয়সমূহ দেখতে এখানে ক্লিক করুন।

Eligibility Criteria:

To secure admission to a GST program, candidates must fulfill specific eligibility criteria, which may vary from one institution to another. However, some common prerequisites often include:

a) Educational Qualification:

– Graduation in a relevant discipline (e.g., General, Science & Technology.)

– Minimum aggregate marks requirement (e.g., 50% or higher)

b) Entrance Exams:

– Clearing a standardized entrance test (such as the GST Admission 2024 Test) with a qualifying score

if you have not

Application Process:

The application process for GST Admission 2024 is easy. The following steps:

a) Registration:

– Visit the official website of the respective institution and complete the registration process by providing the required personal and academic details.

Document Submission:

– After registration, candidates must submit essential documents, including academic transcripts, mark sheets, identification proof, and passport-sized photographs.

c) Entrance Exam:

– Candidates may be required to appear for a specific entrance exam designed to assess their aptitude and knowledge in fields related to GST.

d) Group Discussion/Personal Interview:

– Shortlisted candidates may be called for a group discussion and/or personal interview to evaluate their communication skills, critical thinking abilities, and subject matter expertise.

Benefits of GST Admission 2024 :

Enrolling in a GST program offers numerous benefits for aspiring professionals, such as:

a) Specialized Knowledge:

– Students gain in-depth knowledge about various aspects of GST, including its legal framework, accounting procedures, and implications on businesses.

b) Industry Relevance:

– GST has become a crucial component of the global business landscape. By pursuing a GST program, individuals enhance their employability and open diverse career opportunities in finance, taxation, and consultancy.

c) Professional Accreditation:

– Successful completion of a GST program often leads to professional accreditation or certification, enhancing the credentials of aspiring tax professionals.

d) Networking Opportunities:

– Students get the chance to connect with experienced faculty members, industry experts, and fellow students, fostering valuable professional networks.

The online admission system is the best system for GSA admission in 2024. But

Career Prospects:

A GST program equips graduates with the necessary skills to pursue a successful career in various domains. Some potential career paths include:

a) Tax Consultant:

– As a tax consultant, individuals can help clients navigate the complex world of taxation, provide advisory services, and ensure compliance with GST laws and regulations.

b) Financial Analyst:

– Financial analysts analyze financial data, interpret trends, and make recommendations based on their expertise in GST to optimize business performance.

c) Auditing and Assurance Officer:

– Auditing and assurance officers are vital in examining financial records, ensuring compliance with GST regulations, and detecting discrepancies.

d) Teaching and Academia:

– Graduates of GST programs can venture into teaching and academia, sharing their knowledge with future professionals and contributing to further research and development in the field.

GST admission 2024 last date

I cannot provide real-time information or specific details about events occurring after my knowledge cutoff date in September 2021. For the most accurate and up-to-date information regarding GST admission 2024, including the last date for admission, I recommend checking the official website of the institution or university you are interested in or any other reliable sources that provide information about admissions. They typically provide the most recent and accurate information regarding application deadlines, admission requirements, and other essential details.

GST Admission 2024 Subject list

The GST (Goods and Services Tax) is a comprehensive indirect tax on manufacturing, selling, and consuming goods and services throughout India. However, as of my last knowledge update in September 2021, there was no specific admission subject list for GST in the context of education. GST is a tax law that is applicable to businesses and individuals dealing in the supply of goods and services.

In the field of education, universities and institutions may offer courses related to GST, which could cover various aspects such as:

- GST law and regulations

- GST compliance and implementation

- GST accounting and record-keeping

- GST returns and filing

- GST implications for various industries

These subjects could be part of various academic programs related to accounting, finance, taxation, or business administration. However, it’s advisable to refer to the official website of the educational institution you are interested in or directly contact them for the most accurate and up-to-date information regarding their specific admission subject list and criteria.

gst admission 2024 circular

I apologize, but I don’t have real-time access to specific databases or the internet beyond my last training data, up to September 2021. Therefore, I cannot provide you with the most recent or specific information about the General Since Technology (GST) Admission Circular for the year 2024.

To find the most accurate and up-to-date information, please consider the following steps:

- Visit the official website of the General Since Technology (GST) institution where you are seeking admission.

- Check reputable educational portals, local newspapers, or other reliable sources for the most recent updates on the admission circular for 2024.

- Contact the admissions office or the designated authorities of the General Since Technology (GST) directly to acquire the precise information you need.

I recommend taking the aforementioned steps to ensure you receive the most accurate and reliable information regarding the GST Admission 2024 Circular 2024.

As the field of taxation continues to evolve, acquiring specialized knowledge in GST becomes imperative for professionals aspiring to excel in this domain. GST Admission 2024 provides a gateway to a world of opportunities, unlocking numerous career paths for individuals passionate about finance, taxation, and business management. By understanding the eligibility criteria, application process, and benefits associated with GST Admission 2024, you can embark on a journey toward a rewarding and successful professional future.

FAQ

What are the rules for GST admission 2024?

The rules for admission to the Graduate/Undergraduate School of Technology (GST) can vary depending on the specific institution or university. However, some standard requirements for admission to technology-related programs typically include the following:

Educational Qualifications: Applicants are generally required to have completed their secondary education, including obtaining a high school diploma or an equivalent qualification.

Entrance Examinations: Some institutions might require applicants to take specific entrance examinations, such as standardized tests or aptitude tests, to assess their skills and knowledge in areas relevant to technology and engineering.

Academic Performance: Applicants are often evaluated based on their academic performance in relevant subjects such as mathematics, physics, chemistry, and computer science.

Letters of Recommendation: Some institutions may require applicants to submit letters of recommendation from teachers, professors, or employers who can attest to the applicant’s academic abilities and character.

Statement of Purpose: Applicants may be asked to submit a statement outlining their academic and career goals and reasons for choosing the specific technology program.

Extracurricular Activities: In some cases, participation in extracurricular activities, such as robotics clubs, coding competitions, or internships in relevant fields, may strengthen an applicant’s profile.

Interviews: Certain institutions may require applicants to participate in an interview as part of the admission process. This interview could be conducted to assess the applicant’s communication skills, critical thinking abilities, and passion for the field of technology.

It’s important to note that these rules and requirements can differ from one institution to another. As such, you should consult the specific admission guidelines provided by the Graduate/Undergraduate School of Technology to which you are applying. Additionally, keeping track of any changes to the admission criteria and requirements is crucial, as some institutions may update their guidelines periodically.

What is the minimum GPA for GST?

As of my last knowledge update in September 2021, there isn’t a specific minimum GPA requirement for the GST (Goods and Services Tax) in the context of education. GST is a value-added tax levied on most goods and services sold for domestic consumption. It is a significant indirect tax reform implemented in various countries to replace multiple cascading taxes levied by the central and state governments.

Suppose you are referring to a specific program or scholarship that has a GPA requirement related to GST. In that case, it’s advisable to check the most recent information directly from the concerned institution’s official website or contact the relevant department for accurate and up-to-date details. Remember that policies and requirements can vary depending on the country, educational institution, or organization in question.

What is the duration of GST admission exam?

As of my last knowledge update, the duration of the GST (Graduate Studies Admission Test) exam could vary depending on the specific institution or country where it is administered. The GST exam is not a standardized test like the GRE or GMAT, with defined time limits. Some universities or institutions typically use it as part of their admissions process for graduate programs.

To get the most accurate and updated information on the duration of the GST admission 2024 exam, you should check the official website of the institution where you plan to take the exam or contact the admissions office of the specific university directly. They can provide you with the most recent and precise details regarding the exam structure, duration, and other pertinent information.

General Science & Technology (GSA) admission is a bright future for a student. But any student absent from an examination/can not allow this admission.

আরও জানুন : GSA Admission 2024

Table of Contents